How to reorganize an LLC by merger? Liquidation of a company by merger Reorganization in the form of merger step by step

Joining an LLC to an LLC step-by-step instructions has its own characteristics. The essence of the procedure is the closure of one company through its merger with another or the actual liquidation of an LLC by joining another company with the transfer of all rights and obligations of the liquidated company to the company with which the merger is taking place.

Advantages and disadvantages of the accession procedure

- in the process there is no need to obtain a certificate of full settlement with the Pension Fund of the Russian Federation and the Social Insurance Fund, which would mean checking the correctness of the calculations by these bodies and repaying the debt, which takes up to 2 months;

- savings on state fees: upon merger you need to pay 4,000 rubles (as for registering a new legal entity), merger costs about 1,500 rubles.

The disadvantage is succession, the essence of which is that the absorbing company, after completing the transaction, bears all the risks of paying the debts of the acquired LLC, even if they were identified after registration. The statute of limitations is three years. Therefore, merger is practiced as an alternative to the voluntary and official liquidation of a company without debt.

Step-by-step instructions for joining an LLC to an LLC involve going through several stages.

Stage 1 - preparatory

Initially, each company holds a general meeting of founders with the preparation of minutes in order to:

1 - making a final decision on reorganization, in which it is necessary to prescribe the transfer of rights to the acquiring company for:

- notification of the initiation of a merger by the Federal Tax Service within three days after the decision is made by the last participant;

- publication of a message about what is happening in a special journal;

2 - ratification of the treaty of accession, which stipulates:

- key stages of the procedure and their timing;

- the size and features of the authorized capital after the merger;

- distribution of reorganization costs among participants;

- process manager, etc.

Stage 2 - notification of interested parties

For the Federal Tax Service you should prepare:

At the place of registration of the main company, you must also submit an application for the creation of a new company through reorganization in form P12001.

Documents are endorsed with an electronic signature or signatures certified by a notary and sent to the Federal Tax Service at the place of registration of participants. The Federal Tax Service has the right to request other documents related to this procedure.

After three working days, the tax authorities will issue a certificate of the start of the unification campaign, confirming the introduction of changes to the Unified State Register of Legal Entities.

After receiving the specified paper, the companies have 5 working days to notify creditors. This is done by sending notification letters.

Additionally, two messages about what is happening are published in the “Bulletin of State Registration” with a month interval between them.

If the value of assets (according to the latest balance sheet data) of the companies is more than 3 billion rubles, the merger of an LLC into an LLC is expanded: the merger must have permission from the antimonopoly service.

Extra-budgetary funds are notified by sending letters with acknowledgment of receipt.

Stage 3 - inventory

Inventory is an audit:

- the presence and safety of the company’s assets, recorded and unaccounted for on the balance sheet, as well as account balances;

- obligations to all interested parties (creditors, government agencies);

- rights of claim;

- warehouse accounting and management;

- reliability of information contained in accounting documents.

All property of the LLC and its obligations, regardless of their location, and material assets that do not belong to the company (rented or transferred to it for safekeeping or processing) are subject to verification.

Upon completion of the inventory, the participants of the company draw up and endorse a transfer act.

Stage 4 - registration of accession

Merging an LLC into an LLC, step-by-step instructions regarding the formation of a package of documents for registering transformations with the Federal Tax Service includes contacting the specified authority with the following papers:

- decisions on reorganization (from each participant plus joint);

- application for termination of economic activity on behalf of the acquired company (form P16003);

- an application in form No. P14001 to change the data in the Unified State Register of Legal Entities;

- application in form No. P13001 for registration of adjustments to constituent documents;

- minutes of the general meeting of the founders of the companies;

- deed of transfer;

- accession agreement;

- constituent documents (Charter);

- a receipt for payment of the duty;

- confirmation of notification to interested parties (copies of notices with marks of receipt by recipients, messages from the “Bulletin”).

After 5 working days, the Federal Tax Service will issue:

- extract from the Unified State Register of Legal Entities;

- registration certificate;

- Charter with tax authorities' mark.

Clarifications

During the merger process, it is necessary to draw up a liquidation balance sheet. Sometimes several such interim documents are drawn up. The rights and obligations of the liquidated enterprise are also re-registered to its legal successor, and some creditors will have to be settled before registering the reorganization.

The step-by-step instructions for merging an LLC are somewhat different from those presented above. Liquidation of an LLC through a merger leads to the creation of a fundamentally new economic entity on the basis of closed companies. That is, none of the participants continues their economic activities. Therefore, registration of the closure of all participants and the opening of a new legal entity will be required.

If bankruptcy of an LLC is expected with its subsequent merger, then this is only possible with the participation of an arbitration court.

The use of dummy persons and denomination passports is criminally punishable according to Article 173 (note 1, 2) of the Criminal Code of the Russian Federation. 8 years out of life. What are you writing about?

Liquidation of an enterprise is simply a complicated matter. What is needed to close an LLC or individual entrepreneur, what is important to know and what needs to be done in order not to have problems with the tax authorities in the future.

Reorganization of legal entities: grounds for reform, classification of forms of reorganization of business entities, features of the process and acceptable organizational and legal forms

Liquidation of an enterprise by decision of the owner is the voluntary closure of a business, which can be carried out for a number of reasons.

Step-by-step algorithm for registering an LLC. Part 1 When solving a problem such as opening an LLC, the registration procedure, a step-by-step algorithm makes it possible to plan your actions and create a new enterprise without making a single mistake.

The procedure for liquidating a non-profit organization is determined by Article 19 of the Federal Law “On Non-Profit Organizations”.

Since March 2011, future entrepreneurs have the opportunity to open an individual entrepreneur via the Internet. However, for now the program is valid only for residents of the capital.

You can do business and not be afraid only after passing the state registration procedure. What do you need to open a sole proprietorship? Detailed procedure and all the secrets.

Reorganization by merger 2017 - step-by-step instructions

Reorganization in the form of merger is mutually beneficial for both companies. The main organization that merges the smaller company acquires all its rights and developments, including ownership of well-established trademarks.

For a small business merging into a larger one, such reorganization is an expedited liquidation procedure.

To reduce time and financial losses, companies should adhere to the developed action plan and timely preparation of documents.

Stages of the accession procedure

1. Meeting of participants of the main company and the acquired company.

During the meeting, a resolution is adopted on the chosen method of reorganization, and detailed minutes are kept with a record of speakers and issues on the agenda.

The result of the event is the drawing up of an agreement, which specifies:

- leading and joining parties;

- distribution of expenses between enterprises;

- the amount of authorized capital;

- stages of the process, etc.

In addition to the minutes of the meeting and the agreement, a notice of accession is also drawn up and certified by the notary.

2. Sending the following documents to the tax office

- message with information about joining;

- minutes of the joint meeting and the decision of each organization;

- notification in form P12003;

- other documents required by a specific tax authority.

Despite the apparent similarity of the event, the requirements of tax registrars in different regions may differ significantly.

Simultaneously with the entry in the register, a certificate of initiation of the accession procedure is prepared. Such a certificate will subsequently be issued to a company liquidated through reorganization.

3. Notification of creditors and printing in the State Registration Bulletin.

Each of the reorganized enterprises notifies its creditors about the start of the official merger procedure. Five days are allotted for sending the relevant mail notifications.

Messages are sent for publication in the Bulletin twice (with an intermediate interval of 30 days or more). It is best to send a copy of the protocol of accession to the journal initially, since it may be requested by the editorial board before accepting the application.

4. Carrying out a complete inventory of the acquired company with drawing up a transfer act.

The fact of inventory is reflected in the interim minutes of the joint meeting.

5. Submission of the package to the state registration authorities.

Includes:

- decision on reorganization;

- minutes of the joint meeting;

- application in form P16003, notarized;

- an order form for submitting a notice of intention to reorganize, as well as copies of printed notices in the “Bulletin”;

- transfer act of material resources, obligations and rights;

- accession agreement;

- applications for registration of changes in the constituent documents of the main company and amendments to data about the legal entity.

The tax authority enters into the register an entry about the liquidation of the acquired company and changes in the composition of the main enterprise.

Completion of the procedure is confirmed by a document issued to the representative of the organization within five days.

In addition to the main stages, the acquired company also needs:

- close bank accounts;

- transfer documentation on the state of economic and financial affairs to the archive;

- destroy the company's seal by drawing up an accompanying act.

Step-by-step instructions for reorganizing an LLC by merger

Send by mail

Reorganization of an LLC by merger - step-by-step instructions will help you carry out the procedure in strict accordance with the legal norms that govern it. The article examines each stage of the company's reorganization.

Reorganization by merger: general provisions

By virtue of Art. 51, 57 of the Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ, a company can be reorganized, including through merger.

The result of the procedure is the formation of a single legal entity that unites the authorized capitals of all affiliated organizations. In this case, the acquired companies lose their status as legal entities, that is, they cease to exist. All rights that they had are transferred to the organization to which other companies have joined by way of succession.

Let us consider step by step how the procedure for reorganizing a company through merger should be carried out.

Stage 1. Preparation for the general meeting, inventory of the company’s assets

The decision on reorganization is made exclusively at the general meeting of the company’s participants (clause 2 of article 33 of Federal Law No. 14). A meeting can be convened by both the executive body and the board of directors, an auditor, an auditor or members of the company.

To convene a meeting, the initiator sends a request, on the basis of which the authorized body of the company makes a decision to hold the meeting. The decision contains both information about the form in which the meeting will be held, and other data, in particular, the agenda, according to which the issue of reorganization of the company is planned to be discussed at the meeting.

IMPORTANT! General meetings must be scheduled in all companies participating in the procedure (separately). After a decision is made to conduct a collection, notifications are sent to the organization's participants.

Before carrying out the reorganization, it is necessary to conduct an inventory of the company’s assets (Article 11 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ). This is a procedure for reconciling the property that should be on the balance sheet of the enterprise according to the documentation with the actual assets available. For this purpose, a special commission is created, which carries out all the necessary actions.

Stage 2. Drawing up an accession agreement

According to the requirements of Art. 53 Federal Law No. 14, all organizations that participate in the procedure must enter into an accession agreement. In this case, the agreement must be approved at general meetings of each company, which implies the need for its preliminary preparation.

There are no specific requirements for the contract, but it can include:

- general provisions;

- procedure for carrying out the procedure;

- the procedure for exchanging shares in the authorized capital of the acquired and merging companies;

- procedure for holding a joint general meeting;

- provisions containing the procedure and grounds for termination of the contract;

- information about the succession procedure.

The merging legal entity transfers all rights and obligations to the company to which the merging is made. In this case, rights and obligations are transferred without a transfer act (clause 2 of Article 58 of the Civil Code of the Russian Federation).

Stage 3. Holding general meetings, making decisions on liquidation in the form of merger, other actions

At general meetings, which are held in each company participating in the procedure, issues of reorganization with subsequent liquidation are discussed, and voting is held (open or closed). The decision that the company will be reorganized must be made by all (100%) of the participants, who must vote in the affirmative. The decision must be recorded in the minutes of the meeting.

Clause 1 Art. 60 of the Civil Code of the Russian Federation provides for the obligation, after making decisions, to notify the registration authority about the upcoming reorganization (Article 13.1 of the Law on State Registration of Legal Entities and Individual Entrepreneurs dated 08.08.2001 No. 129-FZ). After this, information about the upcoming reorganization is published in the media (twice, within 2 months).

The tax authority with each of the merging companies reconciles calculations for taxes, fees, penalties, etc. (subclause 11, clause 1, article 32 of the Tax Code of the Russian Federation), after which a reconciliation report is drawn up, which reflects information about the presence or absence of debts on specified payments.

In addition, merging companies must send to the Pension Fund:

- information about each insured employee;

- data on insurance premiums that were accrued and paid;

- register of workers who are insured.

Additionally, merging companies must notify creditors of their upcoming reorganization (Clause 1, Article 60 of the Civil Code of the Russian Federation).

Stage 4. Holding a joint meeting to approve the charter of a single organization and select management bodies

To finalize the procedure, a joint meeting of all firms participating in the reorganization process must be held. The procedure for initiating and holding a joint meeting is not much different from the procedure for organizing a meeting of participants of one company. However, it must be taken into account that the procedure for holding a joint meeting is stipulated in the accession agreement. It is important to notify the participants of all firms involved in the reorganization and maintain a quorum for decision-making.

At the general meeting, the charter of the company is approved (by amending the existing one), which has been joined by other organizations, and management bodies are elected (clause 3 of article 53 of Federal Law No. 14).

The manner in which the meeting is held is determined by the accession agreement. All participants are notified by mail, registered letters. Decisions are made by voting. To adopt the charter, more than 2/3 of the votes are required, and to elect management bodies, more than 3/4 of the votes are required. The results are recorded in the protocol.

Stage 5. Making changes to the Unified State Register of Legal Entities

According to paragraph 4 of Art. 57, paragraph 1, art. 60.1 of the Civil Code of the Russian Federation, state registration of the merger can be carried out after the deadline for appealing the decision on merger has expired (3 months from the date of registration of the start of the reorganization).

The regulations according to which registration is carried out were approved by order of the Ministry of Finance of Russia dated September 30, 2016 No. 169.

The following must be submitted to the tax authority at the place of registration of the company, which is joined by other organizations:

- application in form P16003 (termination of activities of those organizations that are merging), the form of which was approved by order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6/25@.

- accession agreement;

- application in form P13001 (amending the constituent documents, approved by the order of the Federal Tax Service indicated above);

- minutes of the general meeting;

- new charter;

- document confirming payment of the duty (800 rubles);

- application in form 14001 (amending information about a legal entity, approved by the order of the Federal Tax Service indicated above).

The registration period is 5 days.

Thus, the procedure ends with the formation of a single company, which, as a general rule, includes participants of the merged companies, combining their shares in the authorized capital. The above steps will help you get an idea of the sequence in which you need to act when reorganizing a company through merger.

Be the first to know about important tax changes

Have questions? Get quick answers on our forum!

Reorganization of LLC in the form of merger

Reorganization in the form of affiliation - one of the popular options for liquidating a company. Its essence lies in the termination of the work of one or a group of companies with the transfer of rights and obligations to an LLC acting as a legal successor. Often, affiliation helps several organizations combine their available authorized capital to achieve greater efficiency in the use of assets. In addition, reorganization is sometimes used as an alternative to classical liquidation. How is this process organized? How justified is such a step? What features of the procedure do you need to know about? Let's consider these points in more detail.

Is joining an LLC relevant?

Today there are several ways of reorganization, and one of them is the merger of a company. The peculiarity of the methodology is that the rights and obligations that belonged to one legal entity are transferred to the other party. As a rule, this procedure is beneficial to all participants, and its goal is to attract additional funds, improve personnel, develop business and increase profits.

The advantages of reorganization in the form of affiliation include:

- Minimum requirements for paperwork. To carry out this procedure, there is no need to issue certificates of no debt to the Pension Fund and the Social Insurance Fund. At first glance, this advantage seems insignificant, but in practice, paperwork can take a lot of time and effort.

- Lower state duty costs. When compared with a merger, reorganization in the form of affiliation requires less expenses for payment of state duty - no more than 1,500 rubles (versus 4,000 rubles in the case of a merger).

- The emergence of additional risks expressed by subsidiary liability. If during its operation the LLC has already accumulated debts, after the procedures have been carried out, the previous founders take responsibility for them.

- Merging a company involves many steps that must be taken into account during the reorganization process.

If the LLC has no debt, the merger option looks very preferable, because it can save time and money.

Reorganization in the form of affiliation: step by step

To avoid mistakes, you should have step-by-step instructions at hand, with the help of which you can quickly and without additional costs carry out all the procedures. The process of joining a company takes place in several stages.

Preparation of papers and decision making

The first step is to gather the company's participants to make a decision on joining the LLC as part of the enterprise reorganization process. Here an agreement is drawn up, which covers the main stages of the procedure, the amount of authorized capital, principles of cost distribution, the head of the merger process and other nuances.

At this stage, a notification application about the future application of the reorganization methodology is prepared, it is notarized, and a message about the start of the process is issued.

Submission of papers to registration structures

All legal entities participating in the merger must notify the tax service at their place of residence about this process within three days from the day the decision to carry out the reorganization was made. To solve this problem, the following papers must be submitted to the tax service:

- Message (filled out according to form S-09-4).

- A decision taken at general meetings of companies participating in the merger process.

- Other papers taking into account the requirements of the territorial structure.

During the same period, the tax service must receive an application to activate the reorganization process. The Federal Tax Service has three days left to issue a document confirming the start of the accession. During the same period, information is entered into the Unified State Register of Legal Entities.

Notification of credit institutions

The legal entity must inform creditors about this procedure within 5 days from the date of receipt of the certificate. The message is made in writing and sent by mail with mandatory notification of receipt. In addition, the main condition is an inventory of the papers included in the parcel.

Publication in the media

Once creditors are informed, you can move on to the next stage - publishing information about the reorganization through merger in the state registration bulletin. The burden of filing a notice usually falls on the LLC, and the publication itself is organized twice. A month must pass from the date of release of information in the first issue. In rare cases, the magazine that publishes the news requires confirmation in the form of minutes of the general meeting of the affiliation.

Obtaining the consent of the antimonopoly structure

If the assets of the LLC taking part in the reorganization are more than seven billion rubles, it is worth contacting the antimonopoly authority and obtaining approval for the reorganization procedure in the form of merger. This procedure is allotted 30 days from the date of submission of papers.

Inventory of property, as well as execution of the transfer deed

As soon as the notification is made and the antimonopoly authority has given its approval (if it was required), a process of inventorying the LLC’s material assets, as well as obligations in each of the organizations participating in the process, is organized. Based on the information obtained as a result of the inventory, the participants draw up a transfer deed and sign on it.

At the same stage, the founders of the company participating in the reorganization gather. The result of such fees is the introduction of amendments to the constituent documents regarding the merger of the LLC. Next, adjustments are made to the constituent papers, which relate to the inclusion of new founders, as well as an increase in the authorized capital. In addition, at the meeting, bodies are elected that receive the authority to manage the newly created company. The results of the meeting must be recorded in minutes.

Preparation of additional documents

The bureaucratic procedures are not completed yet. To register amendments made to the constituent papers of the LLC, an impressive package of papers is submitted to the state registration authorities, namely the merger agreement, the transfer act, the minutes of the meeting of all companies participating in the merger, as well as the decision to carry out reorganization (general and separately for each LLC ).

In addition to the documents mentioned above, you will need:

- A copy of notifications from the journal, which is used to inform about the joining process.

- Copies of papers confirming receipt by creditors of information about the start of the reorganization process.

- Application for making amendments about the company in the Unified State Register of Legal Entities (form - 14001).

- Application for state registration of amendments in the constituent papers of the main company (form - 13001).

- Application to stop the work of a connected company (form - 16003).

State registration of adjustments

As soon as the information has passed through the media and a secondary publication has been organized, an application can be submitted to government agencies to amend the charter of the LLC, which assumes the role of the main company. At the same stage, an application for termination of activities (liquidation) of companies joining the main LLC is submitted to the registration authorities. When completing this step, the previously discussed package of papers is used. As for applications drawn up on forms 14001, 16003 or 13001, this point must be notarized.

Taking into account the current rules, within five days a new entry appears in the Unified State Register of Legal Entities, confirming the fact of the merger of a group of companies. On the basis of this document, the registration structure transfers the necessary package of papers, and the reorganization process itself is completed.

Subtleties of organizing the process

During reorganization, some legal entities must be prepared to meet a number of additional requirements:

- As noted, if the amount of assets of the merging LLC exceeds 7 billion rubles, approval of the reorganization by the FAS is required. There are other rules that oblige you to undergo approval procedures with the antimonopoly authority (they are prescribed in the legislation).

- If the specifics of the connecting enterprises require obtaining a license, the joining process is available only after receiving this document. This rule applies to companies that engage in communications, sell alcohol, carry out insurance activities, and so on. The legislation clearly defines the deadlines within which the documentation must be reissued.

The connecting company has the right to obtain a license if the mandatory conditions of its work remain unchanged. A similar action must be taken in the case where a license is already in hand, but concerns another territory.

- If among the transferred assets there are results of intellectual work registered legally, it is also impossible to do without re-registration of the copyright holder.

What violations are possible?

In conclusion, it is worth highlighting the mistakes that many LLCs make during the reorganization process. This category includes situations where the decision to join was made by an unauthorized body, or the rights of one (several) shareholders were violated. In such situations, the registration may be invalidated.

It is also worth considering that even after the merger is completed, there are risks of litigation if there is a lack of information in the Unified State Register of Legal Entities, including coverage of losses. If the court decides that the process led to a decrease in competition, the LLC may be reorganized or liquidated.

Liquidation of an LLC by merger - step-by-step instructions in 2016-2017

An LLC may be liquidated by merging with another existing Company. Our lawyers have prepared for you step-by-step instructions for liquidating an LLC by merger.

This procedure is the process of terminating the activities of one or more LLCs with the transfer of all rights and obligations to the successor organization. The LLC being liquidated is excluded from the Unified State Register of Legal Entities, all obligations are transferred by succession to another LLC.

It must be remembered that all debts of the liquidated Company are transferred to the legal successor organization.

Liquidation by merger includes several mandatory steps:

- Preparation of a preliminary package of documents

- Sending documents to the Federal Tax Service

- Notification of creditors

- Publication in the media

- Obtaining consent from the FAS

- Carrying out an inventory

- Holding the second general meeting of participants

- Preparation of the final package of documents

PREPARATION OF A PRELIMINARY PACKAGE OF DOCUMENTS

At this stage, a general meeting of the founders of the acquired and main companies is held. The purpose of the meeting is to make a decision on the accession process and approve the corresponding agreement.

SENDING DOCUMENTS TO THE IFTS

Within three days from the date of the decision to join, it is necessary to notify the tax authority at the place of registration. Required to provide:

- message in form C-09-4 and corresponding decision

- application-notification of reorganization and corresponding decision

After three working days, the tax office is obliged to provide a certificate of the start of the merger procedure with the corresponding entry being made in the Unified State Register of Legal Entities.

NOTICE TO CREDITORS

Within five working days from the date of receipt of the certificate, each of the Companies participating in the process must notify in writing all creditors known to it about the accession. It is recommended to send the message by post with acknowledgment of delivery and a description of the attachment.

PUBLICATION IN THE MEDIA

OBTAINING CONSENT FROM FAS

If the assets of the reorganized Companies according to the latest balance sheets exceed the amount of 7 billion rubles, then in accordance with the Law “On Protection of Competition” it is necessary to obtain the consent of the antimonopoly authority for such actions. The decision must be made no later than 30 days from the date of submission of documents, but the consideration period may be extended.

CONDUCTING INVENTORY

Within all companies, an inventory of property and obligations is carried out with the preparation of a transfer act.

HOLDING THE SECOND GENERAL MEETING OF PARTICIPANTS

A general meeting of the Society's participants is held. The results are documented in the form of a protocol. At the meeting:

- changes are made to the constituent documents of the main company related to the entry of new participants and an increase in the size of the authorized capital;

- The governing bodies of the main society are elected.

PREPARATION OF THE FINAL PACKAGE OF DOCUMENTS

For state registration of changes in the constituent documents of the successor company and liquidation of the acquired company, the following package of documents is required:

- decisions on the reorganization of each company

- application on form 16003

- application on form 14001

- application on form 13001

- minutes of the general meeting of reorganized companies

- accession agreement

- deed of transfer

- copies of messages from the "Bulletin"

- copies of documents confirming receipt by creditors of messages about the start of the procedure

Within fifteen days, an entry on the liquidation of the affiliated legal entities is made in the Unified State Register of Legal Entities and the registration authority issues the necessary documents.

Simple Master of Liquidation LLC

Entering information will take just 15 minutes. Then you can receive two P15001, P16001 and other documents for the tax office.

These documents are 100% relevant in 2017.

Due to ongoing changes in the Russian economy, it is becoming more difficult for many market participants to conduct their activities efficiently and without losses. The reasons can be different: the presence of stronger players, rising prices for raw materials, etc.

Therefore, many of them decide to join forces to create a larger enterprise that can survive in the current conditions and stay afloat. In addition, the reorganization is carried out in order to optimize taxation and management.

Existing methods of enterprise reorganization

Existing civil legislation provides 5 forms for reorganization of enterprises:

Existing civil legislation provides 5 forms for reorganization of enterprises:

- separation;

- selection;

- transformation;

- merger;

- accession.

Only the last two of them are suitable for merging organizations. Each has its own special rules for the order of implementation.

If merger is a procedure in which the organizations participating in it cease to exist, and all their rights and obligations are transferred to a new (created as part of this process) legal entity, then accession a slightly different phenomenon. This is a form of reorganization in which, out of several persons participating in the procedure, at the end only one (joining) remains, and the rest (joining) cease to exist.

I choose one or another form of reorganization, its initiators proceed from the circumstances of a particular situation, the need to preserve any of the participating companies, the complexity of the documentation, and, of course, the goal pursued by carrying out these procedures.

According to the Civil Code of the Russian Federation allowed when reorganizing, combine its various forms, as well as the participation of 2 or more organizations, including different organizational and legal ones.

It is no secret that mergers and acquisitions are carried out, among other things, in order to “liquidate” them. In this case, the process of affiliation is most acceptable, which is facilitated by the absence of the need to create a new organization.

It is no secret that mergers and acquisitions are carried out, among other things, in order to “liquidate” them. In this case, the process of affiliation is most acceptable, which is facilitated by the absence of the need to create a new organization.

If we calculate the time spent on carrying out reorganization actions in the form under consideration, we can establish that at least 3 months must be allocated for these procedures.

Various ways of reorganizing Joint Stock Companies are discussed in the following video story:

Mechanism of accession as part of the reorganization

This procedure is implemented through several stages.

If you have not yet registered an organization, then easiest way This can be done using online services that will help you generate all the necessary documents for free: If you already have an organization and you are thinking about how to simplify and automate accounting and reporting, then the following online services will come to the rescue and will completely replace an accountant at your enterprise and will save a lot of money and time. All reporting is generated automatically, signed electronically and sent automatically online. It is ideal for individual entrepreneurs or LLCs on the simplified tax system, UTII, PSN, TS, OSNO.

Everything happens in a few clicks, without queues and stress. Try it and you will be surprised how easy it has become!

Making a decision on reorganization by each participant

Carrying out this stage depends on the OPF (organizational and legal form) of the enterprise. Thus, in an LLC, decision-making on this issue is within the competence of the general meeting of participants (GMS).

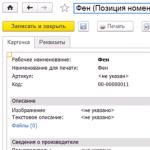

Thus, it is accompanied by the preparation, convening and holding of the General Assembly (as a rule, extraordinary). The said decision should not only determine the main conditions of the reorganization, but also approve the terms of the merger agreement, and if we are talking about the LLC being merged, then deed of transfer.

Thus, it is accompanied by the preparation, convening and holding of the General Assembly (as a rule, extraordinary). The said decision should not only determine the main conditions of the reorganization, but also approve the terms of the merger agreement, and if we are talking about the LLC being merged, then deed of transfer.

Notification of the registration authority (IFTS) about the start of the procedure

According to the requirements of the law, it is necessary to submit a notification in form P12003 and the corresponding decision on reorganization to the authorized bodies. At the same time, the law establishes a period for performing this action - no more than 3 working days from the date of the decision made by the last of the accession participants. It is the authorized representative of the latter, as a rule, who is the applicant when filing a notification.

Notification of creditors about the commencement of relevant procedures

In accordance with Art. 60 of the Civil Code of the Russian Federation, after the decision on reorganization is made, it is necessary to implement notification measures interested parties, namely creditors, government agencies, etc.

For this purpose (after registration by the tax authorities of a notification about the beginning of the process), a corresponding announcement is printed in special media (Bulletin of State Registration). This is done twice (periodically - once a month). It should be taken into account that the notice is published from all participants, those of them who made the decision last or who were assigned such a responsibility by others.

Conclusion of a connection agreement, inventory and transfer of property

In cases provided for by law, a merger agreement is required, which regulates all the conditions of the reorganization, including its procedure and consequences. To conduct this, a special commission is formed, which conducts it and prepares the relevant documents.

In cases provided for by law, a merger agreement is required, which regulates all the conditions of the reorganization, including its procedure and consequences. To conduct this, a special commission is formed, which conducts it and prepares the relevant documents.

The reconciliation of settlements with the tax authorities of the reorganization participants and other necessary actions are carried out. These activities may precede the notification of the Federal Tax Service and interested parties about the reorganization of companies. In addition, it is preparing deed of transfer, according to which the assets and liabilities of the acquired persons are alienated to the acquirer.

It is also necessary to note that, for example, in relation to an LLC, a rule has been established according to which it is required holding a joint OSG companies participating in the merger, where a decision is to be made on making changes to the acquiring company as provided for in the merger agreement and on electing new members of the company’s bodies. This stage does not stand out as independent, however, its existence must be taken into account.

State registration of changes in the information of the Unified State Register of Legal Entities on the reorganization that took place

As part of the implementation of this stage, it is necessary to take into account that final registration of the merger is allowed no earlier than the moment when the deadline for filing complaints against decisions on reorganization expires, which is 3 months from the date of entry into the records of the beginning of the procedure. In addition, at least 30 days must have passed from the date of the last publication.

For registration introduce themselves:

For registration introduce themselves:

- applications (form No. P16003 and form P13001);

- accession agreement;

- deed of transfer;

- decision to increase, amend the charter of the acquiring entity;

- changes to the charter;

- document confirming payment of state duty;

- statement (if changes need to be made regarding controls, etc.);

- other documents that may be required depending on the type of legal entity or the characteristics of its activities (for example, confirmation of changes in the issue of issue-grade securities, if any).

State registration period is no more than 5 working days. Traditionally, reorganization procedures are considered to be completed at this stage.

Solving personnel issues of enterprises

Important when implementing the connection are questions about personnel joining organizations. If possible, it is possible to transfer workers through dismissal and to the acquiring enterprise, or guided by Art. 75 Labor Code of the Russian Federation. Within the latter method, it is necessary to take into account that employees have the right to refuse to work in the acquiring organization, as a result of which they may be fired. In general, as a general rule, reorganization is not a basis for termination.

Important when implementing the connection are questions about personnel joining organizations. If possible, it is possible to transfer workers through dismissal and to the acquiring enterprise, or guided by Art. 75 Labor Code of the Russian Federation. Within the latter method, it is necessary to take into account that employees have the right to refuse to work in the acquiring organization, as a result of which they may be fired. In general, as a general rule, reorganization is not a basis for termination.

If it is not possible to accept the entire staff of the merging organizations, then a preliminary one must be carried out, otherwise, it will all go to the acceding one, and the latter will have to take measures to reduce the number of employees.

However, there are exceptions to the above rules, so the Labor Code of the Russian Federation provides that if the owner of the property of an enterprise changes (which actually happens upon merger), within three months from the date the new owner acquires rights, it is possible to terminate employment contracts with the managers (participants in the merger), their deputies and chief accountants, which is logical.

Some features of the procedure

The reorganization of certain categories of legal entities requires Additional requirements. Thus, antimonopoly legislation establishes cases when reorganization must be carried out with the prior consent of the relevant antimonopoly authority (FAS), for example, if amount of assets of all organizations participating in the merger will amount to more than 7 billion rubles.

If the specifics of the activities of the merging companies require availability of special permission (license), then the acquiring company has the right to carry it out only after re-issuance of licenses. This applies to insurance organizations, alcohol trade, communications companies, etc.

If the specifics of the activities of the merging companies require availability of special permission (license), then the acquiring company has the right to carry it out only after re-issuance of licenses. This applies to insurance organizations, alcohol trade, communications companies, etc.

As a rule, the legislation establishes specific deadlines for re-registration of documentation after the completion of reorganization procedures. The affiliating organization may obtain a license if the conditions that are mandatory are maintained. Appropriate actions must be taken even if it already has a similar license, but, for example, for a different territory (if we are talking about organizing communications).

In a situation where as part of transferred assets there are results of intellectual activity, the rights to which are registered in the prescribed manner, it is also required to re-register to a new copyright holder.

Features of the enterprise reorganization procedure are discussed in this video:

Possible violations of the reorganization process

Issues related to cases where the reorganization was carried out in violation of the law are also important.

Issues related to cases where the reorganization was carried out in violation of the law are also important.

For example, decision on reorganization was adopted by the wrong governing body, or the rights of any participant/shareholder were violated. In these situations, there is a risk that the registration of the termination of the activities of the affiliated organizations will be invalidated.

It is also necessary to take into account that after the above decision was made by the court, the affiliating organization bears all the risks unreliability of information contained in the Unified State Register of Legal Entities, including compensation for losses caused to other persons as a result.

Consequences of violations of order obtaining FAS consent for reorganization will mean that the company can be liquidated or reorganized by a court decision (in the form of separation or division) if there is reason to believe that such merger has led or will lead to a restriction of competition, including the emergence of a dominant entity. And if consent was not requested, then those obligated to send petitions to the antimonopoly authorities will be subject to administrative liability in the form of a fine.

The Russian economy is undergoing significant changes, which have a significant impact on the activities of all enterprises.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

Only by joining their efforts can market participants survive, stay afloat, and optimize taxation and management of legal entities.

Basic information

The current civil legislation provides for the following forms of changing the legal status of legal entities:

- Joining.

- Merger.

- Separation.

- Transformation.

- Selection.

To unite organizations, the first two methods are used. A combination of several of them is also allowed.

What it is

Reorganization of an LLC is the formation of one legal entity from several companies on the basis of legal succession.

As a result, the business expands, the financial position of the enterprise improves, and unnecessary attention from the tax inspectorate is not attracted.

Reorganization is also one of the forms of liquidation of a legal entity. Affiliation is the process of several organizations joining one.

The affiliated companies transfer their responsibilities, rights, and privileges to the main company, and they themselves cease to exist as legal entities (Article 17 of the Federal Law No. 208,).

A larger business entity absorbs their assets and liabilities, while maintaining all their data in the state register (OGRN and TIN).

The decision is formalized by order of the director of the company or the meeting of founders. The final data is reflected in the statement of results and is used in the preparation.

It must be signed by the following persons:

- Chief Accountant.

- Head of the enterprise.

- Chairman of the commission.

Then the finished documentation is submitted to the founder for approval, in accordance with the requirements of the law.

All data on the transfer, amounts of financing, actual and cash expenses must be reflected in the accountant’s general ledger, accounting registers, as well as in the new reporting of the receiving organization.

Sample notification

An announcement about the reorganization of the organization is submitted twice to the publication “Bulletin of State Registration”.

It contains complete information about the participants in the process, its form, conditions and procedure for submitting claims by creditors.

The second notice is submitted one month after the first notice ().

If several companies take part in the process, the announcement on behalf of all is submitted by the last business entity to join.

Written notification of creditors about reorganization in the form of merger occurs within five working days from the date of sending the notification to the registration authority ().

Thus, the guarantee of protection of the rights of creditors is observed. The law does not provide for a unified form of the document, so it can be drawn up in any form.

Employees of the company must be informed about the changes. As a result, the work books of employees are corrected.

Notifications in any form are sent to each employee (). Workers are required to provide a receipt for their receipt.

This is done two months before changes made to employment contracts come into force.

Documentation package

Registration of the reorganization of a business entity is carried out by the tax inspectorate at the location of the legal entity.

To carry out the procedure, the following package of documents must be submitted:

- The adopted protocol decision of the general meeting of participants.

- Confirmation of publication in the media.

- Agreement on accession.

- Documents confirming the absence of debt to the Pension Fund.

- For a joint stock company, information is required on the form of the authorized capital, passport details of the general director and chief accountant.

- Latest accounting report.

- List of creditors and debtors.

- Statement ( , ).

- Constituent documents in two copies.

- Certificate of registration in the Unified State Register of Legal Entities.

- Transfer deed.

- on payment ().

The list of documents may be changed depending on the legal form of the business entity. Details can be found at the territorial office of the registrar or on the Federal Tax Service website.

Submission of documentation

There are several possible ways to submit documents:

- by visiting the inspection in person;

- entrusting this to a representative on the basis of a power of attorney;

- through post offices by valuable parcel post;

- electronic.

After checking the package of documents, the tax inspector is obliged to issue the appropriate document.

Obtaining documentation

After five working days, you can go pick up the completed documents at the tax office. The registrar must provide:

- Excerpt from the Unified State Register of Legal Entities.

- Certificate of state registration.

- A copy of the constituent document with a mark from the controlling body.

Registration will be considered final when the time allotted for creditors to submit claims has expired.

This will happen no earlier than three months from the date the data is entered into the state register. In this case, at least a month must pass from the date of publication of the last notification.

Deadlines

The process of joining a legal entity itself takes two or more months. State registration takes place in five working days.

At least a month must pass between publications in news magazines. Workers are notified two months before final changes are made.

Notification to creditors is sent within five business days from the date of submission of documentation to the tax office.

Questions that arise

There are special requirements for the reorganization of the antimonopoly authority. Current

The law prescribes the need to obtain the consent of the FAS.

This is especially true in cases where the amount of all assets exceeds seven billion rubles. If the affiliated organizations operate under a license, then the main company must reissue it.

Only after this will she be able to carry out work. The legislation sets specific deadlines for resolving this issue.

- insurance companies;

- companies selling alcohol;

- enterprises providing communication services.

Reorganized enterprises have the right to switch to. The transition procedure is determined by the provisions of the Tax Code of the Russian Federation.

To do this, a notification is submitted to the registration authority for consideration.

What are the consequences

If the process is carried out in violation of legal requirements, the reorganization will be declared invalid.

The reason may be the following:

- The wrong governing body made the decision to join.

- The rights of the shareholder(s) have been violated.

- The registrar was provided with false information.

- No FAS consent.

When an organization is at the stage of reorganization, merger, accounting reports are submitted according to the established schedule and in full.

The procedure is regulated by regulations of the Ministry of Finance. The taxpayer is also required to pay all taxes, fees, and insurance premiums.

Unresolved personnel issues

The transfer of working personnel of the merging companies is carried out as follows:

- According to Article 75 of the Labor Code of the Russian Federation, employees are automatically transferred to the staff of the acquiring organization. If the worker refuses, the employer has the right to terminate the employment contract with him.

- Employees leave one company and are hired by another.

- Before the affiliation process begins, the staff is reduced.

Nuances for a budgetary institution (state-owned)

Since budgetary institutions are created to achieve non-profit goals (cultural, charitable, scientific, social, educational, health protection), they are subject to.

In addition, based on paragraph one, the budgetary organization is obliged to notify the Federal Tax Service of Russia in writing within three days after the decision is made about the start of the reorganization procedure.

The notification must indicate the organizational and legal form of the enterprise being created.

Is it possible to be fired during the procedure?

On his own initiative, the director does not have the right to fire a pregnant woman (). An employee can receive a payment only on his own initiative.

According to the fifth part, during the reorganization of an enterprise, the employment relationship with the employee does not end.

The employee's position remains stable, despite changes in the legal status of the employer.

If an employee has expressed a desire to work under new management, the employer is obliged to take the following actions:

- Publish.

- Conclude additional agreements to employment contracts containing information about the future employer.

- Make appropriate entries in work books and.

If an employee refuses a job offer, he is given a notice indicating:

- forms of enterprise reorganization;

- dates of the reorganization process;

- companies that have undergone changes;

- the proposed position and working conditions;

- conditions for termination of the employment contract.

Merger is one of the ways to liquidate legal ownership structures, this also applies to LLCs. In fact, this is a certain scheme of action that involves the transfer of rights from one company to another. The first receives the status of liquidation and ceases operations, and the second operates, having assumed additional obligations. Often, such a procedure contributes to business expansion and the merger of a number of subsidiaries.

Features of the procedure

The merger of an LLC is similar to the merger of legal organizations, however, it does not provide for the formation of a company on the basis of legal entities that have ceased to operate. This does not have a significant impact on the results of liquidation, but it is necessary to carefully select the company to which the merger will take place. Such an organization will become the legal successor and will continue to operate for a certain time after the completion of the accession process.

The following types of LLC can take part in the liquidation procedure by merger:

- Having no debts or having settled their debt obligations through reorganization. At the same time, the opinion of creditors should not become an obstacle to completing the liquidation and registering the fact of merger with the tax authorities.

- They set the goal of a relatively quick (up to four months) end of the company’s activities with less financial losses than during a merger.

- Unable to take the risks associated with the introduction of quick methods of alternative liquidation (sale of the enterprise, replacement of founders, etc.).

Liquidation of an LLC through merger often becomes the best option for ending operations for a company having financial problems. In this case, management responsibilities are officially transferred to another legal entity, and in order to reduce risks it is necessary to incur large losses. A competent approach to solving the issue helps to achieve the goal.

Before liquidating a business by merging with another company, consider all the pros and cons of such a step.

Stages of LLC liquidation by merger

The procedure under consideration is divided into several stages.

Preliminary preparation of documents

At the initial stage, the founders of all organizations participating in the procedure gather. At the meeting, a verdict is passed on liquidation through merger, and an agreement on merger is approved. This document determines the main stages of the entire process, the size of the authorized capital of the new company, the amount of expenses of participants during the procedure, as well as the party managing the process itself.

An enterprise can be liquidated only by decision of the general meeting of owners

An enterprise can be liquidated only by decision of the general meeting of owners Each of the communities taking part in the procedure makes a decision reflecting the fact of transfer of powers to the governing community. They relate to notification of tax authorities about accession and publication of information about this fact in the printed publication “Bulletin of State Registration”.

Then an application for future accession is prepared: it must be notarized. A message is created about the initiation of the procedure under consideration in form C-09–4 to notify the tax authorities at the place of registration of legal entities.

Sending materials to state registration authorities

All organizations participating in the liquidation of an LLC are required to notify the tax authorities at the place of registration within three days from the date of the verdict on the procedure. During this period, it is required to send an application to initiate the merger procedure to the tax authorities at the place of registration of the parent company. At the end of the specified period, the Federal Tax Service is obliged to issue an official document about the start of the accession process. At the same time, the established entry is made in the Unified State Register of Legal Entities.

Ensure that the tax office is properly notified of upcoming accession procedures

Ensure that the tax office is properly notified of upcoming accession procedures Notification of creditors

Within five days from the date of execution of the document on the beginning of the merger, each of the organizations participating in the process is obliged to notify all its creditors about this in writing. It is better to send such a message by mail with a delivery notification and a description of the attachment.

Notify creditors about the liquidation of the company by merger - this will help maintain good business relations with them and restructure existing debt

Notify creditors about the liquidation of the company by merger - this will help maintain good business relations with them and restructure existing debt Publication in the media

The notice of liquidation must be published in the publication “Bulletin of State Registration”. As a rule, such publication is made by the parent company, the one to which the merger takes place. Submission of information must be completed twice. The second one is done 30 days after the first one is released.

Publishing an announcement in the State Registration Bulletin will help avoid demands from creditors to extend the liquidation period of the company

Publishing an announcement in the State Registration Bulletin will help avoid demands from creditors to extend the liquidation period of the company Obtaining permission from the antimonopoly authority

Consent to join is required if the total assets of the communities subject to liquidation exceed 3 billion rubles. Permission must be obtained no later than a month from the date of submission of documents; the time frame may change by agreement of the parties.

Drawing up a transfer act and inventory of property

The parties involved in the liquidation carry out an inventory of valuables and intangible assets and distribute responsibilities. In accordance with the information obtained from the inventory results, a property transfer act is drawn up.

A meeting of community members participating in the procedure is held, the agenda of which includes the following issues:

- changes are stipulated in the constituent documents of the parent organization in connection with the expansion of the authorized capital and the addition of new members;

- elections of the leadership of the parent organization are held.

The results of the meeting are recorded in the compiled minutes.

Property inventory will help you preserve important assets and get rid of unnecessary junk

Property inventory will help you preserve important assets and get rid of unnecessary junk Carrying out state registration of amendments

After an additional message is published in the State Registration Bulletin, information about the liquidation of the affiliated community and changes in the statutory documents of the parent organization are submitted to the state registration authorities. After 5 days, information about the liquidation of the affiliated LLC is entered into the Unified State Register of Legal Entities, after which the registration authority issues the required documents. This completes the process of liquidating an LLC by merger.

Documents required for liquidation in the form of merger

To legally carry out the procedure for liquidation of an LLC by merger, the following documents are required:

- The decision of the meeting of LLC founders to initiate the merger process.

- Affiliation agreement with the parent organization.

- Application to initiate liquidation by merger.

- Notice of LLC liquidation (Form C-09–4).

- A written message to creditors about the upcoming liquidation procedure of the enterprise.

- The act of transferring property to an LLC.

Documents relating to the liquidation of the company must be properly executed, since they will have to be presented to regulatory authorities within the next 4 years

Documents relating to the liquidation of the company must be properly executed, since they will have to be presented to regulatory authorities within the next 4 years LLC liquidation cost

The cost of liquidating an LLC is determined by the amount of the duty established by the state - 1.5 thousand rubles. Additional payment is required for the services of organizations performing such a turnkey procedure. The estimated cost of their services is determined in the range from 30 to 50 thousand rubles.

Possible risks during liquidation

Any action to liquidate a company is risky. Claims do not arise only in cases where the liquidation of an LLC through merger is carried out in compliance with all legal requirements. And it is also important to have a pre-made plan for the operation.

The main risk is that creditors present demands for debt repayment against the management of the acquired LLC. Moreover, this can happen after the end of the accession.

Paperwork must be completed strictly within certain deadlines.

Paperwork must be completed strictly within certain deadlines. Before carrying out the procedure in question, it is recommended to verify the following:

- the enterprise has no debts at all or can be paid off during the merger process;

- the appointed successor does not cause any suspicion among regulatory authorities;

- the LLC merger procedure can be carried out without attracting attention from the tax administration and law enforcement agencies;

- in the current situation, the option of merging an LLC is the most justified.

If a company has large debts, there is no point in liquidating it. This will immediately attract the attention of regulatory authorities and will only worsen the situation.

Liquidating an LLC by merging it has many advantages. There is no need to take a large number of certificates about the existence of debts, the amount of the fee is lower than for a merger, the corresponding records of liquidation are entered into the Unified State Register of Legal Entities. There are significantly fewer disadvantages: they are all associated with the risk of taking on the organization’s existing debts. Having weighed the pros and cons, management has the right to decide whether this option suits it or not.

A common option for liquidating a company is reorganization by merger. This event often serves as the basis for business consolidation, uniting several small subsidiaries.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

Features of the event

Along with changing the management or address of an enterprise through the sale of a business, merger is a type of alternative liquidation. This method is considered more trustworthy due to the exclusion of former firms from the state register, overlooking the presence of a successor with the transfer of all obligations of the acquired firms. That is, the risk of liability of the new organization increases in proportion to the presence of risks in other enterprises.

What is this?

The essence of the procedure is a set of actions to terminate the activities of the acquired enterprise (one or more) with the transfer of legal succession to the main company - the successor, which continues to operate. At the same time, companies that join completely complete their independent work, going through the procedure of liquidation and exclusion from the register. The difference from a similar merger procedure is that during the merger process all participating organizations cease their work and a completely new successor enterprise is registered.

Note: it is worth remembering that during the accession process the taxpayer is not required to independently carry out actions to notify the tax authorities.

If it turns out that the Federal Tax Service employees do not have the necessary information about the termination of the organization’s existence as a result of reorganization, all that is required from the company is to submit a copy of the certificate of the completed procedure with a covering letter from the former head of the company stating that he is no longer listed as an official person, and the organization completed its activities as a result of the merger. Based on these documents, the content of information about the organization in the register will be corrected by making the necessary entries by tax officials.

Feasibility of the procedure

Which companies should use the affiliation method? First of all, these are companies that are thinking about liquidation due to the presence of large amounts of debt under various obligations, including tax obligations. In addition, these are companies in whose accounting there are significant gaps and it is cheaper to get rid of the business in this way than to restore accounting, undergo possible audits, and communicate with tax and other authorities.

If the management of the company has made a decision to terminate the financial and economic activities of the enterprise, it is worth considering all possible methods of liquidation before the start of the measures: official, alternative, voluntary, through bankruptcy.

Study the pros and cons of all procedures and only then proceed directly to implementation.

The main disadvantage of any “gray” scheme is that the liquidated company continues to be the subject of an offense and accumulate penalties even in the event of liquidation. Consequently, all previous participants/owners can at any time be brought to administrative, criminal and tax liability for violations that occurred during the period of operation.

The undoubted advantages of this method are:

- firstly, lower financial costs compared to other methods of reorganization (the amount of the duty is not four thousand rubles, but one and a half);

- secondly, there is no need to obtain certificates about the presence/absence of debts to social funds - the Pension Fund and the Social Insurance Fund, which significantly saves time in the harsh conditions of modern business;

- thirdly, the legal subtleties of the procedure are such that the merging organizations cease their activities by making an entry in the unified register;

- fourthly, with almost 90% probability, this is the absence of tax audits, especially if the participants are not large taxpayers or arrears. After joining, all responsibilities for accrual/payment of budgetary and extra-budgetary payments are transferred to the legal successor without any difficulties.

Liquidation by merger in stages

In this form of LLC liquidation, several main stages of the procedure can be distinguished, namely those relating to:

- preparation of initial documentation;

- providing documentation to registration structures;

- notifications to creditors and interested parties;

- publishing information in print media;

- obtaining permission from antimonopoly authorities;

- carrying out inventory actions;

- drawing up a transfer act;

- preparation of final documentation;

- registration of changed data in government agencies.

Package of documents

Before starting to draw up the initial forms of documents, each of the merging companies should organize general meetings of founders/participants for the purpose of reviewing and approving decisions on reorganization and signing the corresponding agreement.

This agreement should regulate the main stages of the process:

- deadlines;

- the amount of the authorized capital of the successor company;

- distribution of financial costs among the joining companies;

- appointment of the main enterprise as the process manager, etc.

All decisions of the merging participants must include a provision on the transfer of powers to the selected main company to inform the Federal Tax Service and publicly post notes in the media.

In addition to the above documents, at this stage you should fill out the following forms:

- statement notifying the state. authorities on the upcoming accession (subject to notarization);

- messages in form S-09-4 (submitted to the tax office at the legal address);

- additional forms, the list of which must be clarified directly with the registration authorities.

After approval of the decision, all participants in the reorganization, within up to 3 days, should notify their Federal Tax Service about the upcoming event, providing: decisions, messages in form C-09-4, and other documentation.

The main participant should also notify its Federal Tax Service and provide: decisions and statements. Three days later, tax inspectors make entries in the register about the fact of the start of the procedure and issue certificates.

Notification, publication

Within 5 days after receiving the certificate, all participants are required to begin measures to notify creditors. Notification must be carried out in writing by mail by sending registered letters with postal notification forms and an inventory attached. It is mandatory to draw up a document such as.

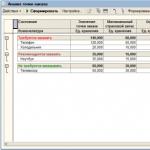

The register of creditors must include the following:

- list of identified creditors;

- amounts of designated debts;

- grounds for making demands;

- designated order of repayment.

The register is compiled in rubles or in foreign currency (in relation to creditors, settlements for which were carried out in foreign currency units) at the rate of the Central Bank at the time of the start of the liquidation event.

What requirements can be included in the register:

- outstanding obligations to pay for goods (works/services);

- borrowed funds received, including accrued interest;

- amounts of compensation;

- amounts resulting from illicit enrichment.

To be included in the list, creditors must submit their requirements in the prescribed manner. If, despite the presentation of demands, the creditor was not included in the register, he has the right to apply for restoration to arbitration.

In addition, all interested parties should take care of the availability of documentation proving debts, such as contracts, certificates of completion of work, delivery notes and invoices, and other business correspondence.

Only after the claims submitted in a timely manner are repaid, the undeclared amounts are repaid.

The next stage, often carried out by the main participant, is the publication of notes in a special publication “Bulletin of State. registration". This action is carried out twice with the publication of a repeated message no earlier than a month after the initial one.

Watch a video about the responsibility of business owners in the event of liquidation of the enterprise

Permission from the antimonopoly authority

According to the current competition law, a number of particularly large enterprises may require the consent of the antimonopoly service.

Such enterprises include those whose assets, according to the latest data, exceeded 3 billion rubles.

The time frame for making a decision is set individually, usually thirty days from the date of provision of information.

Inventory and transfer act

Each of the reorganized enterprises is required to conduct an inventory of property and monetary assets and liabilities. Data obtained during inventory activities are the basis for drawing up such an important form as the transfer deed.

Without this act, reorganization cannot be carried out.

The information specified in the document becomes the basis for the subsequent compilation of general balance sheets. In addition, in the future the new enterprise will put new property on its balance sheet and will be able to account for.

Registering changes

At the last stage, in order for the fact of accession to be successfully registered, it is necessary to correctly prepare the final package of documentation, which includes copies of:

- Decisions (for each enterprise and general).

- Applications in the form (submitted by all affiliated organizations).

- Applications in the form (submitted by the main enterprise).

- Minutes of the general meeting of all members of the reorganization.

- Reorganization agreements.

- Transfer deed.

- Copies of the publication note.

- Copies of the notice to all interested parties.

After re-publication in the Bulletin has taken place, application forms for the liquidation of affiliated companies and for amendments to the constituent documentation of the main company should be filled out.

The forms listed in paragraphs 2-4 are subject to notarization. Five days after the submission of the final forms, an entry is made in the register, the necessary certificates are issued - the procedure is completed.

Risks

Despite the obvious advantages of the method considered, there are always two sides to the coin. Likewise, merger, being a type of alternative liquidation, has negative consequences in the form, first of all, of huge risks of subsidiary liability.